CMU Students Help Low-Income Workers Claim Tax Credits Worth Thousands

Media Inquiries

Every year, millions of low-income workers miss out on the Earned Income Tax Credit (EITC), leaving about $7 billion in unclaimed refunds(opens in new window). A team of graduate students at Carnegie Mellon University’s Heinz College of Information Systems and Public Policy(opens in new window) set out to change that.

Partnering with the National League of Cities(opens in new window), they created easy-to-understand materials and an online tool to help people learn about the credit and find free tax prep services. Their campaign shows what the credit can mean in everyday terms — like how an average $2,400 refund could cover a month’s rent or eight weeks of groceries — and is already being shared with cities and nonprofits across the country.

The students pursued this problem as part of Professor Chris Goranson(opens in new window)’s seven-week Policy Innovation Lab course(opens in new window), which tasks students with creating a high-impact public service product in collaboration with a government or nonprofit client. The team consisted of Samiha Islam, Yuxin Zheng, Ana Rowley, Mitul Jhaveri and Laura Santos.

“There's millions of people that are eligible for these tax refunds that can help you pay for groceries, rent, child care,” Islam said. “But structural barriers in the tax filing system make it difficult for people to get the benefits. Given that we can't simplify the whole tax filing system ourselves, how can we at least make the existing processes more effective?”

Developing the project

In the most recent tax year, the maximum an eligible taxpayer could receive was between $632 and $7,830(opens in new window) from the EITC, depending on factors such as their income and household size.

To learn about the challenges people face in accessing the EITC, the students interviewed the United Way of Southwestern Pennsylvania(opens in new window), along with tax filing support groups, local government officials and other stakeholders. They found that people are unaware of their eligibility, don’t know how to file for the benefit, or find the process intimidating or burdensome.

The gaps in awareness, clarity and guidance became the focal point of their project. “We looked at some of the IRS marketing materials, which are a bit technical and intimidating for an everyday person to look at,” Islam said.

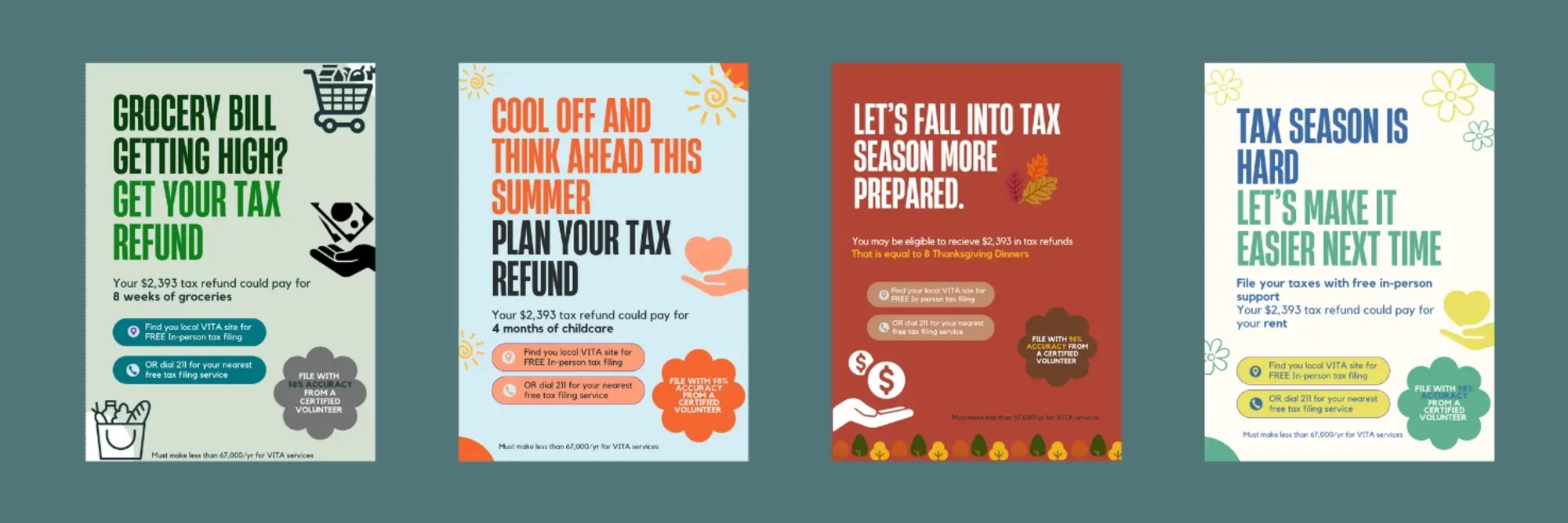

So, the team developed marketing materials — infographics, posters and boilerplate write-ups for nonprofits to use — that illustrate the benefits of claiming the EITC in plain language.

The materials also include information on accessing Volunteer Income Tax Assistance (VITA) sites, where people earning $67,000 a year or less can receive free tax return preparation. The materials are “not just letting you know that you're eligible for the EITC, but giving you a place to go to help you file for it,” Islam said.

Once they had created the marketing materials, the students focused on developing a platform to help taxpayers locate a VITA site near them. The team contacted VITA sites for key pieces of data, such as the languages the volunteers speak, the nearest bus lines to the site and the accessibility features at the location.

David Park, director of data and business analytics at the National League of Cities, met with the students a handful of times and was thoroughly impressed by the results. As the Policy Innovation Lab course came to a close, Park shared the students’ materials with his nonprofit connections in New York City and the Dallas-Fort Worth metropolitan area.

“I love the students’ curiosity,” Park said. “I loved how they were able to make good use of the short amount of time we had. It seems like basic stuff, but when I’d send them a stack of readings, they’d come back with questions and ideas.”

Goranson said the EITC project has met the aims of the Policy Innovation Lab course particularly well. “Not only did the students identify a solution that ended up being beneficial to the partner, but the project became a larger, more ambitious effort that will hopefully connect citizens with the services they need. That’s really exciting,” he said.

Adapting along the way

Islam knew the team would potentially run into obstacles and need to pivot as the project progressed — and that’s exactly what happened.

Originally, the National League of Cities sought for the students to use artificial intelligence to analyze public IRS data and identify neighborhoods where few people have received the EITC. But the team encountered problems with the data. The IRS data showed the number of people who received the credit but not the total number of eligible people, which was needed to understand how many people missed out on the benefit.

“In order to use AI, you need a pretty complete dataset, which is not what we had,” Zheng said.

The team decided to stray away from the idea, but they initially struggled to make the case for changing course to the National League of Cities. They sought Goranson’s advice, and after more clearly presenting their reasoning to the National League of Cities, the students moved forward with the marketing campaign and VITA site search tool.

They did not abandon the original idea entirely: As part of their project deliverables, the team created guidelines on how the National League of Cities could eventually get the data needed to use AI.

This sort of pivot is common in the Policy Innovation Lab course, Goranson said.

“In this case, what the students ultimately identified was a number of different ways to help reach potential participants, which would lead to bigger impact, but ultimately wouldn't have been as obvious had the students not been so proactively learning about the problem by speaking to as many people as they could,” Goranson said.

Having to pivot was stressful, Islam said, especially because the team only had a few weeks to deliver a product to the National League of Cities. But even if the project had not worked out, Goranson said the students would have still learned valuable skills.

“A lot of times, the real work can be messy. There's no clear set of instructions. It's not always clear what you're going to do, or who it's really for, and you have to do a lot of work to figure it out. At Heinz, there are a number of opportunities for students to put their skills to the test, figure out what works and learn a lot along the way,” he said.

The impact of Heinz College

This summer, Islam is interning at the Tax Policy Center, a think tank from the Urban Institute and Brookings Institution. She’s evaluating best practices for a statewide EITC uptake campaign in Maryland, led by the comptroller and backed by $300,000 in funding from Gov. Wes Moore.

She said the EITC project at Heinz College, and the Policy Innovation Lab course as a whole, “is the whole reason that I managed to get this internship.”

The coursework at Heinz College emphasizes not only technical skills but also the ways those skills can be applied to serve the public, Islam said. The Project Innovation Lab course reflects that emphasis. “I feel like it gives value to our education and the work that we're doing, knowing that what we're doing is actually going to help people,” she said.

Zheng valued pursuing the EITC project with a diverse team. Some students had a technical background, while others were more research-oriented; some were first-years, others second-years.

“It speaks to Heinz's interdisciplinary curriculum, which is really about bringing people with different backgrounds together and working together,” she said.